What Financial Forecasting Really Means in 2026

Forget the old school budgets written once a year and forgotten by Q2. Modern financial forecasting is dynamic, continuous, and essential. It’s about using real time data to make smarter calls not just hoping the year end numbers land in your favor.

Today, forecasting means building adaptable models that can shift with business needs. Think revenue projections based on customer trends, expense forecasting tied to supply chain dynamics, and cash flow scenarios that actually reflect reality. In short, it’s financial planning with both hands on the wheel.

Why does this matter now more than ever? Because businesses no longer have the luxury of slow decisions. Market conditions change overnight. Agile isn’t a buzzword it’s survival. A solid forecast lets leaders pivot fast, take calculated risks, and avoid expensive missteps. It’s not about predicting the future with 100% accuracy. It’s about being ready for it.

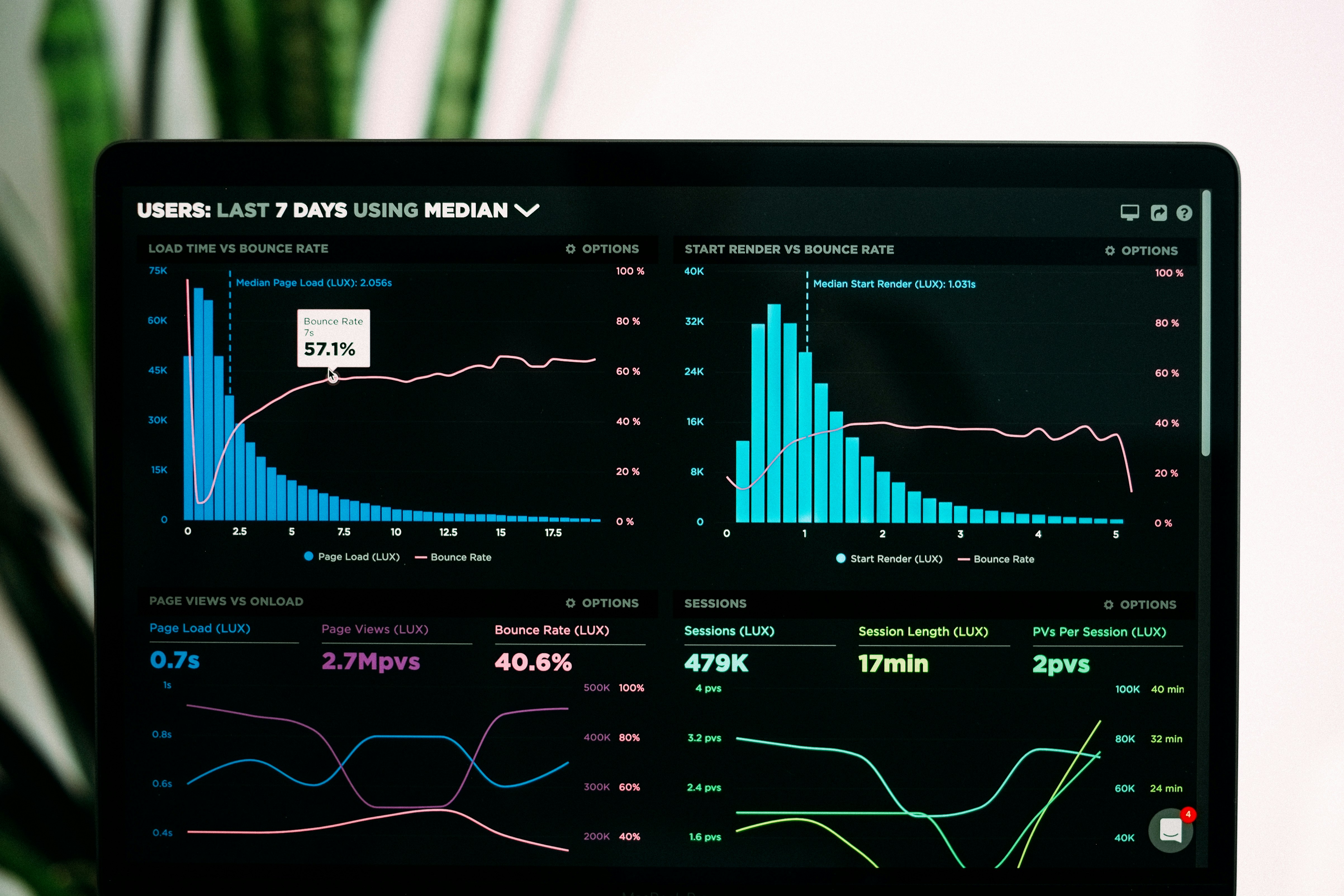

The tech helping make that possible? Tools like AI powered analytics, cloud based accounting systems, and real time dashboards. Platforms such as Float, Mosaic, and Planful are turning forecasting from a spreadsheet headache into a living, breathing part of strategy. The result: better timing, better decisions, and a clearer path forward.

If you’re not forecasting, you’re not steering you’re just along for the ride.

Data Driven Decisions: How Forecasting Steers Strategy

Financial forecasting isn’t just about numbers on a spreadsheet it’s about direction. Your revenue and expense projections give you the map. When done right, they tell you when to lean into growth or when to tighten the belt. Expansion plans should live or die based on what your financial models say, not gut instinct. A clear forecast tells you whether you can afford that new hire, boost inventory ahead of a seasonal uptick, or test a new market without putting your baseline at risk.

Good forecasts also take the guesswork out of long term planning. You’re not just flying blind into 2026 you’re walking through best case, worst case, and most likely scenarios. Think of it like this: if revenue spikes 15%, does the plan hold up? What if it drops 10%? Scenario modeling lets you simulate pressure points before reality hits, giving you time to adjust.

Smart businesses don’t plan big moves blindly. They use forecasting to see around corners and that’s what gives them the edge.

Projecting Cash Flow for Smarter Growth

Growth looks good on paper until the cash runs dry. That’s why week to week cash visibility isn’t a nice to have anymore. It’s non negotiable. Businesses that can see their cash position in near real time make better decisions, faster. They know when to double down, when to pause, and when to pivot.

More importantly, a positive cash flow forecast isn’t just a safety net it’s a launchpad. When leaders trust their numbers, they take smarter risks. They invest in R&D, test new markets, or hire ahead of the curve. Innovation needs capital, but it also needs clarity. Forecasting provides both.

But forecasts only work if they match reality. That means pulling in live financial data from banking, billing, and inventory systems not last month’s numbers from a PDF report. Today’s tools make that possible, integrating all the moving pieces so your forecasts don’t just guess they guide. Predicting cash flow with accuracy isn’t magic. It’s discipline, data, and the willingness to look ahead instead of over your shoulder.

Real Impact: From Planning to Performance

Forecasting isn’t just a back office exercise anymore it’s a strategic edge. For businesses hammered by unpredictable markets or sudden operational shifts, forecasting has been the difference between survival and shutdown. When done well, it flags warning signs early: costs creeping upward, sales dipping, cash reserves thinning. Real companies lean on these insights to pivot fast before the problem explodes.

Take timing funding rounds, for example. Several growth startups have sidestepped capital crunches by mapping their cash flow six to twelve months ahead. Forecasting helped them identify the sweet spot just enough traction to attract smart money, without running the tank dry. That kind of foresight beats blind scrambling any day.

Overextension is another silent killer. Businesses chasing rapid growth without watching their financial health often burn out. Predictive forecasting helps leaders see when they’re about to overhire or overspend. It’s less about guesswork and more about guardrails that create room to grow safely.

If you’re scaling, forecasting should sit at the core of your decision making. And if you’re looking for creative, data driven ways to fund that path forward, check out 5 Creative Financing Options for Scaling Your Business.

Common Pitfalls and How to Avoid Them

Financial forecasting is only as strong as the assumptions behind it. For many businesses, inaccurate or outdated forecasts can lead to decisions that feel right in the moment but miss the bigger picture. Here are three critical pitfalls to watch out for and how to steer clear of them:

Relying on Static Data in a Dynamic Environment

Business conditions change frequently. Whether it’s supply chain stress, regulatory updates, or sudden customer behavior shifts, static forecasting models won’t reflect the current reality.

Problem: Using last year’s figures or outdated trends to predict future performance

Solution: Update your numbers regularly and incorporate real time data inputs

Tip: Use forecasting tools that auto sync with your financial systems for live accuracy

Ignoring Market Shifts or Operational Blind Spots

Forecasts can become dangerously misleading if they overlook external shifts or internal inefficiencies. A narrow focus on known variables may miss key disruptors.

Problem: Overlooking changes in consumer demand, competitor activity, or cost volatility

Solution: Build flexibility into your models to incorporate external indicators and internal process reviews

Tip: Schedule quarterly scenario workshops to surface hidden risks and assumptions

Underestimating the Impact of Small Deviations

A forecast that appears “close enough” can still create compounding issues over time. Small misalignments in revenue, expense, or cash timing can jeopardize strategy.

Problem: Brushing off minor financial variances as anomalies

Solution: Dig into small deviations during monthly reviews they often mark the start of larger trends

Tip: Implement alert systems for key metric deviations beyond a certain threshold

Avoiding these common mistakes doesn’t just make your forecast more accurate it turns it into a powerful decision making tool that evolves alongside your business.

Building a Forecasting Habit

Financial forecasting isn’t a once a year exercise. To stay agile, businesses must make forecasting a regular part of their operational rhythm. Whether it’s monthly or even weekly, consistent review and updating are key to staying aligned with fast changing conditions.

Move from Annual to Ongoing

Annual forecasts provide a useful high level view, but they miss the mark in today’s dynamic markets. Instead, establish forecasting as an ongoing process to maintain accuracy and responsiveness.

Monthly reviews allow for course correction based on recent data trends

Weekly check ins are ideal for businesses with fluctuating cash flow or seasonal sales

Rolling forecasts keep models fluid by continually adjusting projections based on the most current information

Make Forecasting Collaborative

Forecasting works best when it’s integrated into the broader culture of decision making. Everyone from finance to operations should understand its value and contribute insights where relevant.

Include forecasting updates in key strategic meetings

Encourage department leaders to bring real world context to forecast reviews

Train teams on interpreting forecast models, not just producing them

Choose Tools That Scale with You

Technology is essential for turning forecasting into a reliable and repeatable habit. The right tools reduce manual work and allow teams to focus on analysis, not just data entry.

Cloud based forecasting platforms enable real time collaboration and updates

AI powered models offer predictive capabilities that grow more accurate over time

Integrations with your existing accounting or ERP systems streamline data flow and reduce errors

Don’t underestimate the impact of consistent forecasting. When it’s baked into your weekly or monthly operations, it stops being a chore and starts becoming your most reliable decision making asset.

Looking Ahead

Forecasting beyond 2026 won’t just be about more data it’ll be about smarter interpretation. The best in class models will mix bleeding edge machine learning with boots on the ground human intuition. Tools will get faster, sure, but what will set businesses apart is how they contextualize what the models spit out.

AI will handle heavy lifting: cleaning messy datasets, spotting anomalies, and running endless what if scenarios at speed. But it’s human insight that will tune the inputs, ask the right questions, and recognize when a forecast just doesn’t fit the lived reality of a market.

You’ll see predictive modeling that’s deeply embedded into operational systems sales platforms, inventory tools, even HR dashboards. Forecasting will evolve from being a static report to being a live, breathing guide, steering real time course corrections.

Here’s the truth: Forecasting is no longer just about the numbers. It’s a discipline in strategic thinking. It’s equal parts data and direction. Companies that treat it like a quick spreadsheet exercise will fall behind. The ones that treat it like foresight in practice those will lead.