Investing News Aggr8finance: Major Market Movements This Cycle

1. Rate Decisions Hold, Not Drop

Fed and ECB both keep rates elevated, stalling hopes of nearterm cuts. Bond yields hold, capital rotates from growth/tech into “safer” plays: consumer staples, utilities, and diversified industrials. Auto loan, mortgage, and business borrowing rates remain high. Pressure builds on levered sectors.

Routine: Rotate defensive each quarter until central policy shifts.

2. Earnings Season Surprises

Big tech mixed: generative AI revenues boost margins, but cloud and device business split—Amazon and Microsoft lead, Apple flattens. Industrial and financials beat analyst targets on expense cuts, not revenue surge. Consumer discretionary weakens—retail, travel, and restaurant stocks fade after holiday spike.

Investing news aggr8finance logs every estimate miss and earnings beat—adjust exposure after each cycle, never just at yearend.

3. IPO Market Climbs, But Discipline Reigns

Tech IPOs return, but with lower prices and stricter lockups. Investor sentiment: cautious optimism. Most IPO investors log for 30/90day postlaunch performance and cut losers fast. SPACs continue to fade; regulation and skepticism shrink pipeline.

IPO fever is dead—routine due diligence leads.

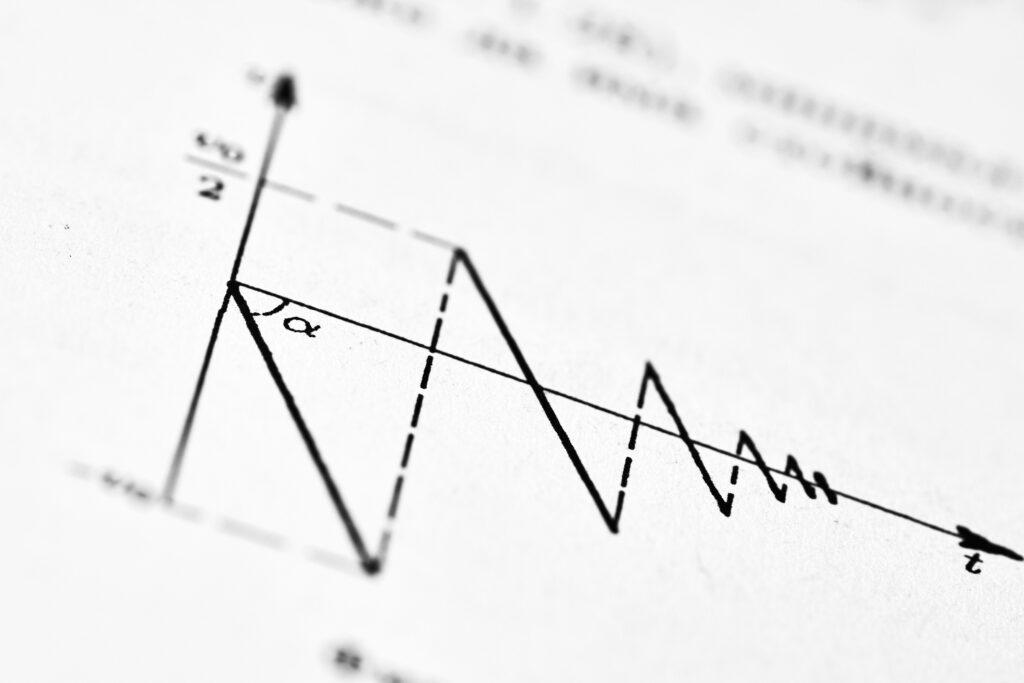

4. Volatility and Global Rotation

Rising volatility index (VIX) drives riskoff routine for portfolios; cash and shortterm bonds as ballast. EM equity, especially India and Brazil, attract flows as China slows. Watch currency headwinds. Oil/gas prices spike on supply disruption and policy risks; energy sector outperforms.

Rebalance after major international headlines, not just U.S. market news.

5. Sector ShakeUps

Health care and insurers outperform as predictability and cash reserves command premium. Clean energy, battery, and EV stocks spike on policy, but rapid rotation and regulatory headlines are doubleedged for valuation. Legacy blue chips recover as risk appetite drops; dividend payers regain attention.

Investing news aggr8finance logs sector leadership for disciplined portfolio allocation.

6. Mergers, Buybacks, and Layoffs

Big buyback programs return in banking and tech; layoffs signal cost discipline, insulate balance sheets. M&A activity in energy and health—consolidation as a defense against price/expense volatility. Document all major moves for watch lists and future sector shifts.

7. Regulatory Changes and Compliance News

Data privacy (EU, U.S. states) and ESG rules tighten; big names fined or forced into correction. Shortselling, leverage, and margin rules updated for major retail brokerages. Document all updates—compliance cost now bakes into forward guidance, not just headlines.

Routine for Handling Investing News Aggr8finance

Daily: set 15minute block for market news—scan aggr8finance, WSJ, Bloomberg headlines, and specific sector feeds. Weekly: update watchlist, document any buys, sells, rebalance, or policydriven moves. Quarterly: measure win/loss ratio for newsbased actions, log any drift from written allocation.

Always compare plan to reality.

Action Steps From Recent Stock Market Updates

Audit all holdings postearnings: raise allocation to sectors beating guidance, cut laggards. Keep a running log of “news moves”—why, effect, and result. Resist panic trading; only adjust on routine day unless stoploss/profit triggers are met.

Pitfalls and Red Flags

Overreacting to every headline or socialdriven swing. Ignoring quarterly or annual rotation and ending up overweight in battered sectors. Forgetting postnews audit or skipping fundamentals for fear/greed impulses.

Team and Solo Investor Discipline

For family/firm portfolios: set routine fullteam news debrief and document every major reallocation. Solo: keep a written “investment news log” for pattern review and error correction.

Summing Up: Investing News Aggr8finance

Set daily, weekly, and quarterly news review and action blocks. Prune information and sources monthly—focus on feeds and writers who move markets (not just hottake pundits). Audit both portfolio and news log after each big cycle. Use wins/losses from discipline, not impulse, to refine routine.

Conclusion

Engineering profit in the stock market is about structure—routine log, review, and reaction, not hypechasing. Stay ahead with investing news aggr8finance: focus on major rate, earnings, and regulatory moves. Audit, rebalance, track, and repeat every week, every quarter. Routine is your advantage—discipline, not luck, compounds wealth.

Founder & Chief Strategist

Founder & Chief Strategist